When price bubbles or crashes approach exhaustion, a signature wave pattern emerges.

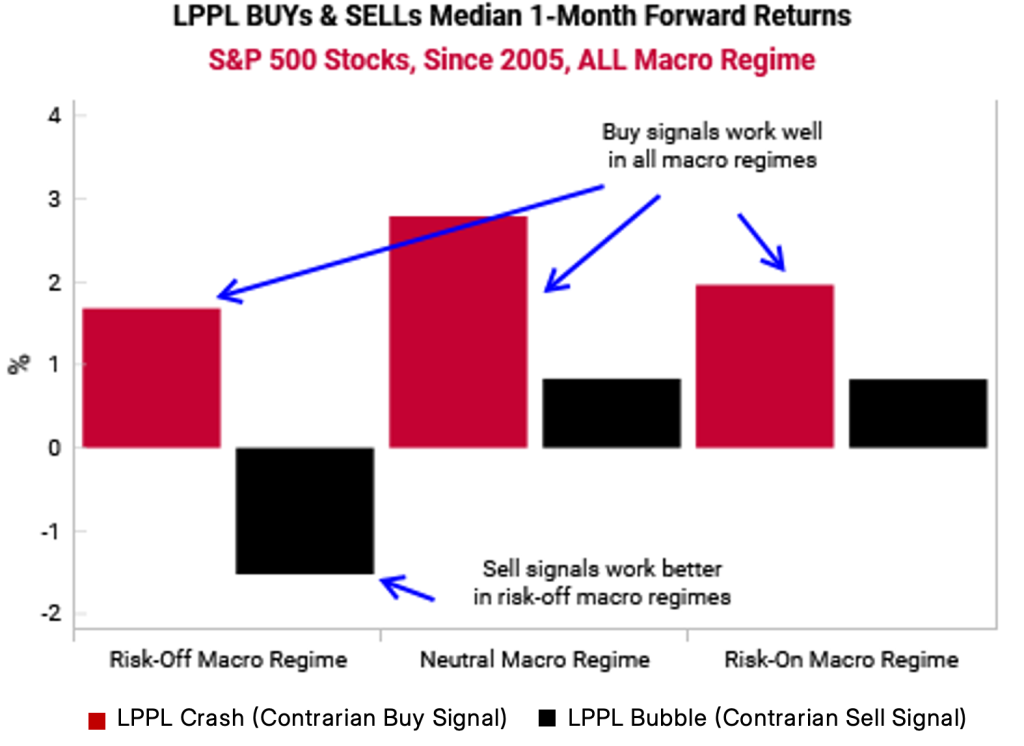

We use log periodic power laws (LPPL) to find these patterns of peak euphoria and panic, flagging tactical price reversals.

Coverage

Russell 3k, MSCI ACWI, equity regions + sectors, fixed income, commodities, and currencies.

Inputs:

The only input for LPPL is price.

LPPL is a mathematical function that combines exponential growth with periodic oscillations. We use it to look for periods in price action where opinion is becoming highly uniform.

Given price is the only input, LPPL works well when combined with fundamental, macro, or policy context.

In Q4 2023 unrealized losses in US bond portfolios combined with under hedging led to a disorderly sell off and rise in bond yields. Our LPPL model picked up on the cascading price action and flagged when forced selling would begin to exhaust.