Macro doesn’t matter until it does. We deliver one number to manage Macro risk.

Growth, inflation, liquidity, and policy are deeply connected, making macro analysis challenging, but essential.

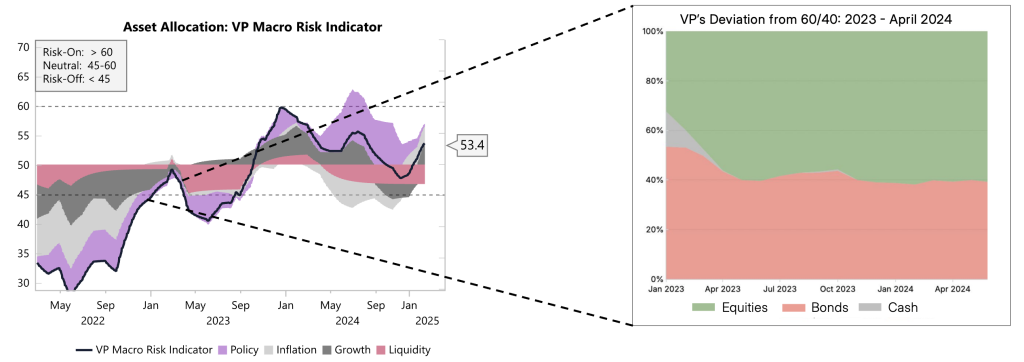

Our Macro Risk model translates our best cyclical indicators into a single number to help scale risk exposures up and down.

Coverage

One model for Global Macro Risk.

Inputs:

Growth + Inflation LEI’s

Central Bank Policy Models

Liquidity Models

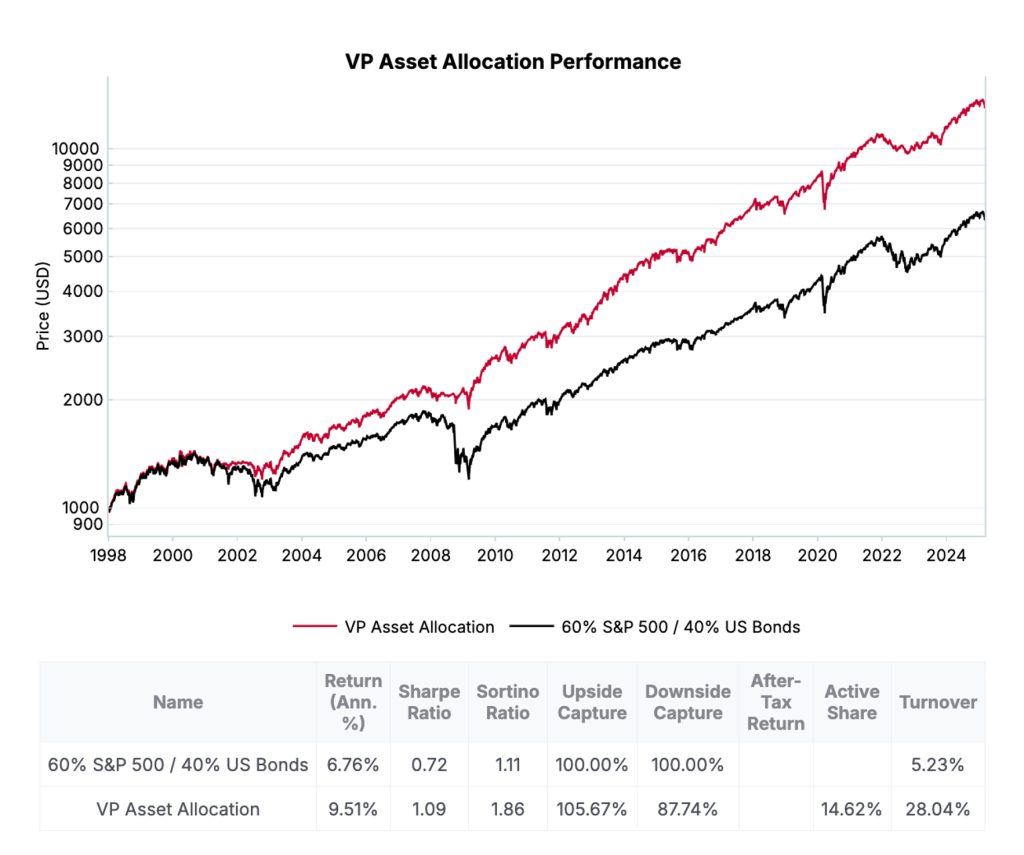

We train our model with 60/40 downside volatility as the definition of macro risk.

We use machine learning techniques to understand how the four macro categories interact, then we manually audit the output to ensure decision trees are intuitive.

Sometimes the prevailing macro narrative turns out wrong, even when the concerns were valid. The most important thing is to adapt when the data starts to prove the narrative wrong. Our Macro Risk Regime picked up on legitimate recession concerns at the start of 2023, but as the year developed the underlying macro components improved which got our model portfolio back to neutral allocation by April.