Liquidity is a hierarchy. In good times, all forms of money seem equal. In crises, there’s a flight to safer, higher-quality money at the top.

We quantify liquidity in terms of levels, rate of change, and price using insights from monetary history.

Coverage

Three indicators for global liquidity

Inputs

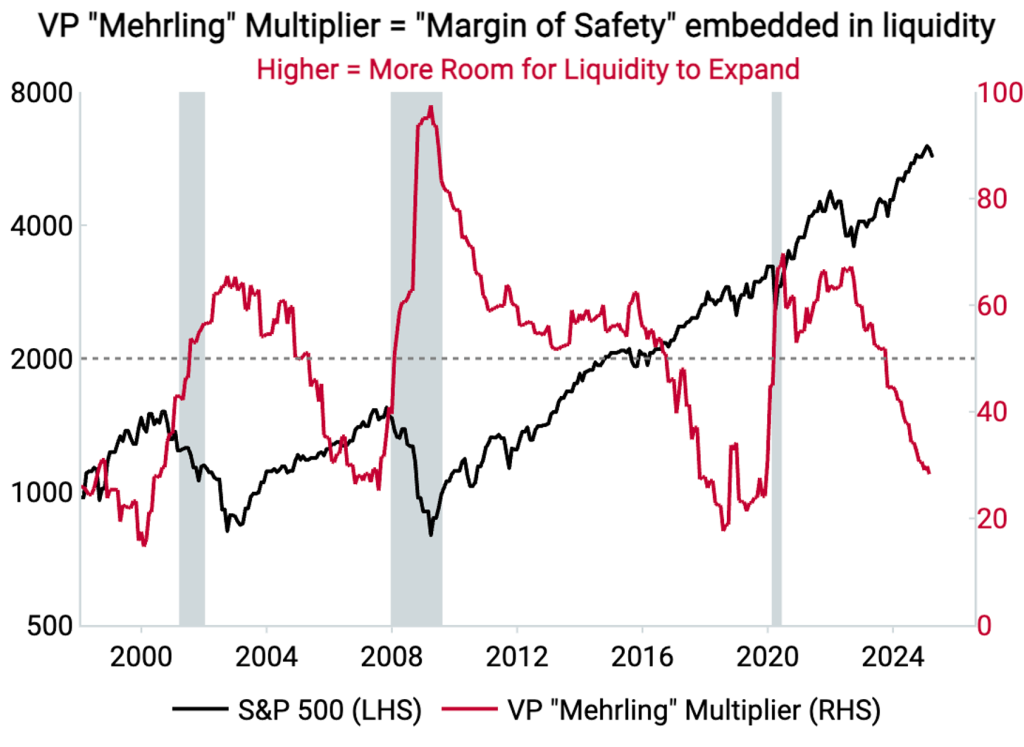

Mehrling Multiplier: Deposits/Loans, Reserves/Loans, Deposits/Securities, Reserves/Securities, Loans/Securities, Reserves/Deposits

Business Cycle Financing Index: Diffusion of change in G20 Central Bank policies

Global Exceass Liquidity: Real M1 growth – Economic Growth

Just as P/E measures whether there is enough earnings to support the current market cap of equities, VP’s Mehrling Multiplier measures if there is enough high-quality money to support assets.

This measure of liquidity has provided important context at historical turning points– for example warning of more downside risks in 2007 and more upside risks in 2020.